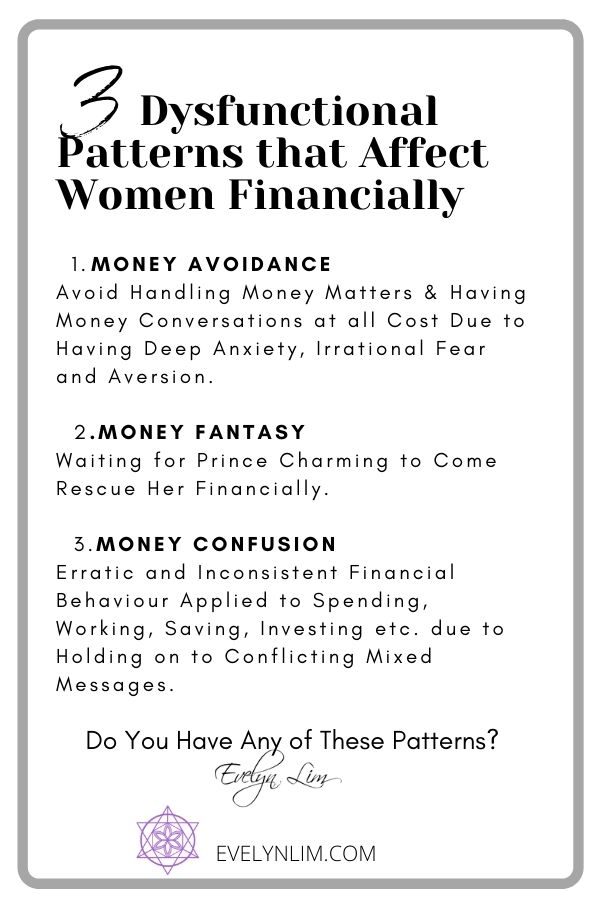

3 Dysfunctional Patterns that Can Affect You Financially

Are you in any of the 3 following scenarios…

1. Do you tend to “check out” every time you need to look at your finances or have a money discussion…and it is because you are feeling averse, nervous and fearful?

2. Do you get into frequent arguments with your spouse over money matters, …which makes you secretly wish if he can “just measure up” and provide the family with a more comfortable lifestyle, so that these conflicts can stop?

3. Do you find yourself going through erratic spending patterns…for example, there are times when you behave as if you are totally broke even when you’ve got money in the bank…and then there are other times when you are spending lavishly on unnecessary items?

If you are a woman with any of the above patterns, this article is meant for you.

As the patterns drive our behaviour, they often result in poorer outcomes. Even though times have changed, many women continue to suffer financially from having a unhealthy relationship with money. While these patterns originate eons ago, they are still prevalent today.

Recently, when I highlighted what some of these dysfunctional patterns are to workshop participants, they found it eye opening. Suddenly, they realised they had been in self-sabotage. These patterns had been in their way for getting a better grip on their finances.

In this article, I’d like to share what were the 3 common ones that they have acknowledged to (and which applies to the above 3 scenarios mentioned at the top of this article)…

What the 3 Dysfunctional Patterns That Affect Women Are

1. Money Avoidance

You apply money avoidance whether in looking at your credit card spending, investing, working, contributions etc. Whenever it is time to have a serious financial discussions, you suddenly have a stomach ache, there is something else more urgent that you need to attend to or you can’t show up. If they happen often enough, they are signs of money avoidance.

It also happens when you prefer to have someone look through the numbers in your accounts and you operate in the blind faith that “no news is good news.”

2. Money Fantasy

You adopt the fantasy of having a Prince Charming rescue you, so that he can fill the gaps of your needs; especially financial ones. The idea may have come from the Cinderella fairy tales that you have been fed on when you were young. However, buying into fantasy ideas may prove to be disempowering in your real adult life.

3. Money Confusion

When you show up with erratic and inconsistent behaviour that affects your finances, it could stem from confusion. Some confusing messages could be related to gender. Confusion is often rooted in mixed messages that you have internalised whether they come from your parents or from society about women “not being good enough“, “being of the inferior sex”, “not being able to manage money” or “women are bad with money” and yet having to thrive financially in your adult life.

When driven by confusion or chaos, you may take care of someone else’s needs over yours or expect others to take care of your needs excessively. You are unclear about your financial priorities. Or you may make the unwise decisions in your spending or investing altogether.

Learn to Take Charge

Learn to Take Charge

Unfortunately, money avoidance can create negative consequences. These days, no one can run away from having to handle money to some degree. In fact, the more responsibility you take on money matters, the more you stand to gain.

It is crucial to know that we don’t need anyone else to rescue us and that we have what it takes to contribute meaningfully, even if we choose to stay home and be the main caregivers to our children. We can still play an important part in managing finances.

The great news is that once you bring light to and make a definite positive shift away from dysfunctional patterns, your finances will start to improve.

It’s helpful to realise about addressing issues at root cause.

Such dysfunctional patterns did not happen out of the blue.

As we know, in most cultures during olden times, women were not encouraged to work. We were financially dependent on the men in the household. Men were the ones who brought in the bacon, while the women stayed home to take care of the kids and household.

Thus, women in the past had thoughts, beliefs and ideas that are rather different from those in modern age, Even though those days are no longer present, unfortunately, we may have inherited some of the beliefs and ideas from our mothers and grandmothers. With no or little experience to manage money, women in the past could also have developed a fear of looking into financial matters.

Hence, if you have any of the following signs…

* irrational fear when it comes to money matters,

* where you are feeling crippled by anxiety when needing to look at budgeting or investing,

* feeling nausea when you need to ask for the money,

these disruptions need to be released at root cause, so that we can install a new set of empowering beliefs that will serve us today.

Forge A New Modern Feminine Role

The women clients I tend to attract have the same dream: financial independence, freedom, personal fulfilment, community and doing the work that we love.

We would like to create a life that balance our needs and dreams. In anything, I have observed that the lockdown restrictions are now increasingly making us even more aware about the benefits of running their own business and working from home (well, I began mine 10 years ago).

Hence, if you are an aspiring female entrepreneur, a coach, an energy healer, a freelance offering your digital marketing service or if you have already started running a business online, there is no better time than now to ride these changes. You are here in the right space, at right time, redefining a new role. Very importantly, you are creating a new definition for the self, for your sisters, daughters and for future generations.

What is true is that if you are a business owner, having money blocks in the way can stop you from generating success. Hence it is imperative that you clear them. Fortunately, as I have discovered, it is possible to release disruptions and rewrite past beliefs with more empowering ones (with an integration at the somatic level).

The journey to freedom truly starts with observing what your behaviour is like and identifying if there are any dysfunctional patterns.

Love and Abundance Always,

Evelyn Lim

Abundance Life Coach

Your Comments

Do you have any of the 3 above patterns? Share your thoughts and comments below.